Most people think the Section 179 tax deduction is some mysterious or complicated tax code. It really isn’t and it can help you add new forklifts to your fleet. Of course, the equipment must be purchased and put into service before the ball drops in Times Square. We suggest you act quickly.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. When you buy or lease a forklift or other qualifying equipment, you can deduct the full purchase price from your gross income. It’s an incentive created by the U.S. government to encourage businesses to reinvest in themselves.

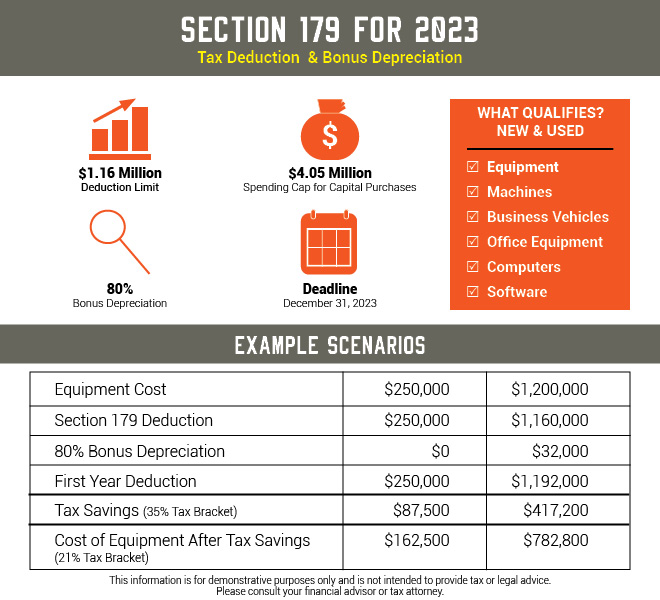

Section 179 Deduction Limits for 2023:

The Section 179 deduction limit for 2023 is $1,160,000. Your company can deduct the full cost of qualifying equipment (new or used), up to $2.89M from your 2023 taxable income. This deduction is good until you reach $4.05 million in purchases for the year.

Section 179 is Meant for Small and Mid-sized Companies

Section 179 helps small and mid-sized companies reinvest in their businesses. The full $1.16M deduction can be claimed up to the $2.89M equipment purchases limit. Once that number is reached, the Section 179 deduction decreases dollar-for-dollar and reaches zero once $4,050,000 worth of equipment is purchased/financed.

About the Section 179 Deadline

The Section 179 deduction has proven wildly popular with small and mid-sized companies. But there is a deadline. The equipment must be purchased/financed and put into service by 11:59 pm on December 31st, 2023.

Bonus Depreciation

Bonus depreciation is offered some years, and some years it isn’t. Right now in 2023, it’s being offered at 80%.

The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is “new to you”), while Bonus Depreciation has only covered new equipment only until the most recent tax law passed. In a switch from recent years, the bonus depreciation now includes used equipment.

We recommend that you plan ahead and order your equipment soon so you can take delivery by the end of the year. Of course, we also recommend that you consult with your financial advisor or tax attorney.